1) Key Insights

Registering my referral for support here:

Solv Protocol initially launched with a fundraising platform using Initial Voucher Offering (IVO) through its Financial NFTs based on the ERC3525 standard, developed in-house. However, the IVO model didn’t gain significant traction, with TVL hovering around $30M.

The initial phase was challenging as TVL stagnated during the Launchpad wave of 2021, but the introduction of V3 with a focus on Arbitrum played a crucial role in helping Solv recover.

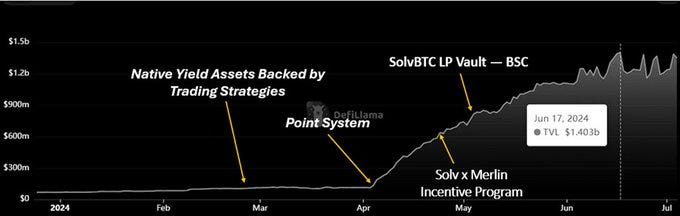

As Arbitrum gradually lost market share to other ecosystems, Solv introduced Native Yield Assets backed by Trading Strategies, laying a solid foundation for future TVL growth.

The real surge began with the launch of Solv’s Point System, combined with partnerships in ecosystems offering Point Incentives, creating a positive synergy that propelled Solv’s TVL past the $1B mark.

2) Quick Overview of Solv Protocol

@SolvProtocol is a native yield platform built on decentralized asset management infrastructure, designed specifically for tokenizing and aggregating high-quality yield opportunities across the industry. It serves as a unified liquidity gateway, reducing barriers and costs for users seeking to access premium investment opportunities.

Solv began by launching SolvBTC offering yield opportunities for BTC, ETH, and stablecoins such as USDC and USDT. These vaults mark the initial step in Solv Finance's journey to deliver native yield across a wide range of assets.

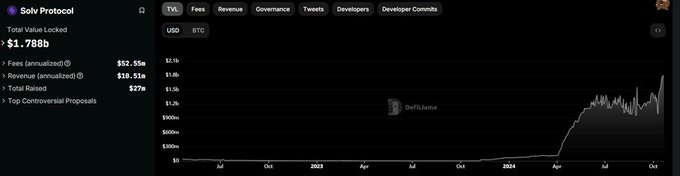

The protocol has since been upgraded to version V3, with Solv Finance using this enhanced version to provide services to its users. As of now, Solv Protocol has reached a Total Value Locked (TVL) of $1.788 billion.

In this article, instead of focusing on the operational mechanics of Solv Protocol, I will conduct a comprehensive analysis of the Go-to-Market strategies Solv has implemented, which have played a pivotal role in the project's impressive recovery and explosive growth.

I will also explore its future development directions and examine how Solv has adeptly adapted to market fluctuations, both past and present, to solidify its position in an increasingly competitive landscape.

3) Solv's Journey: Breaking Through Milestones at Every Stage

3.1) Vesting Voucher: The Genesis of Solv Protocol Amidst the Launchpad Boom

3.1.1) ERC-3525 – The Foundation for Innovation

Solv initially launched as a platform utilizing the concept of Initial Voucher Offering (IVO) through the ERC-3525 standard. Developed by @RyanChow_DeFi (Co-Founder of Solv) and the@SolvProtocol team,ERC-3525 introduced Semi-Fungible Tokens, an advanced hybrid version of NFTs that builds upon the ERC-721 standard.

This innovative token model allows NFTs to possess both fungible and non-fungible attributes, paving the way for Solv Protocol to introduce Financial NFTs. This strategic move helped Solv carve out a unique position during the rapid growth of IDO Launchpads at the time.

3.1.2) Solv Protocol: A Revolution in Liquidity Management and Capital Raising

The year 2021 witnessed an explosion of new fundraising methods such as IDOs (Initial DEX Offerings), along with innovative variants like Initial Farming Offering (IFO) and Initial Twitter Offering (ITO)...

According to@CryptoRank_io, in just January 2021 alone, 21 projects successfully raised a total of $8.04 million. By the end of the year, this number skyrocketed to 413 projects, with total funds raised reaching $512.91 million—a staggering 6,279.48% increase in capital and 1,867% growth in the number of projects.

https://cryptorank.io/ico-analytics

Despite the explosive growth of Launchpads, the market still faced significant challenges. In the primary market, token allocation deals typically only represented the right to claim tokens in the future, leading to liquidity issues. Meanwhile, over-the-counter (OTC) trading lacked transparency, relied heavily on contracts and intermediaries, which increased transaction costs and time.

Solv Protocol introduced an innovative solution with the creation of Vesting Vouchers—NFTs representing token vesting. These NFTs can be fractioned, combined, and traded on any NFT-supporting platform or used as collateral on lending platforms through the Initial Voucher Offering (IVO) mechanism.

Vesting Vouchers, inspired by real-world needs, serve as efficient liquidity management tools, offering investors the opportunity to optimize their returns. As mentioned in the context of ERC-3525, Solv’s Vouchers are not just special financial NFTs; they are smart asset management tools compatible with ERC-721 and tradable on platforms like OpenSea.

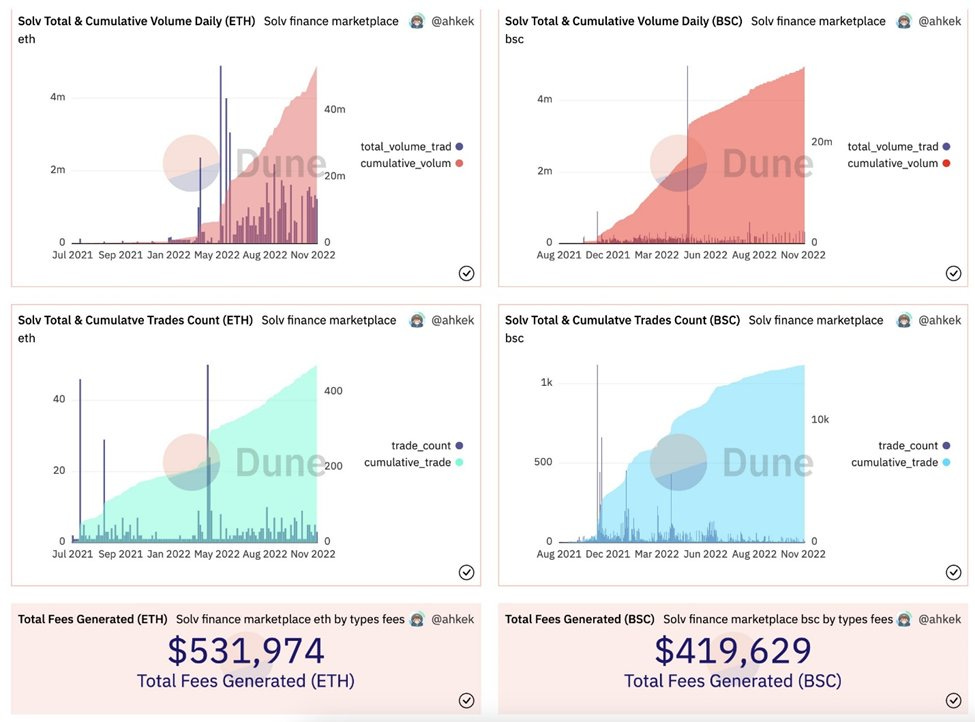

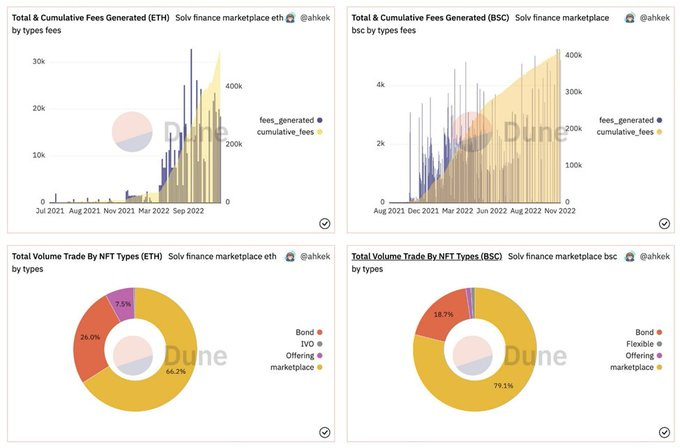

However, in 2021, Solv remained relatively modest, with TVL only increasing from $30 million to $36 million between August and October. It wasn't until 2022, amidst market events like the Luna and FTX collapses, that demand on Solv surged. Cumulative trading volumes on Ethereum and BNB Chain spiked, coinciding with the appearance of several “black swan” events in the market.

https://x.com/SolvProtocol/status/1600221321396297728/photo/2

This contributed significantly to Solv Protocol's cumulative fees, generating over 30K ETH on Ethereum and more than 400K BNB on BNB Chain. The majority of these fees were driven by the marketplace activity, particularly fueled by the high demand for trading Financial NFTs.

https://x.com/SolvProtocol/status/1600221321396297728/photo/2

3.2) The Comeback and Stepping Stone for a Rapid Growth

3.2.1) The Genesis of Version 3

It seems that things haven't been going well for this Launchpad segment since reaching its all-time high (ATH) in December 2021. The total fundraising has plummeted sharply, dropping from $798.79M at its peak in January 2024 to just $208.11M—a staggering decline of 73.95%.

https://cryptorank.io/ico-analytics

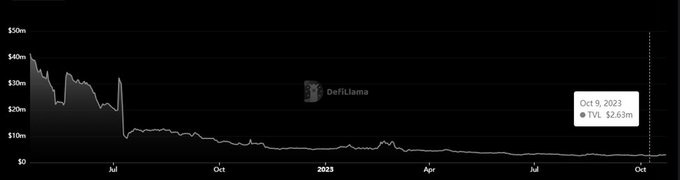

Under the strong influence of market conditions and a sharp decline in demand for Launchpads, Solv's TVL experienced a dramatic drop, plummeting from $40M to approximately $2M between April 2022 and October 2023.

On March 21, 2023, Solv officially launched Version 3 to better align with market conditions. This upgrade focuses on three core areas: on-chain fund creation, clearing, and settlement services, while maintaining the foundational elements from Version 1.

Solv V3 offers a comprehensive, flexible, and innovative solution for asset managers, allowing them to optimize capital management processes and enhance operational efficiency without the need for collateral.

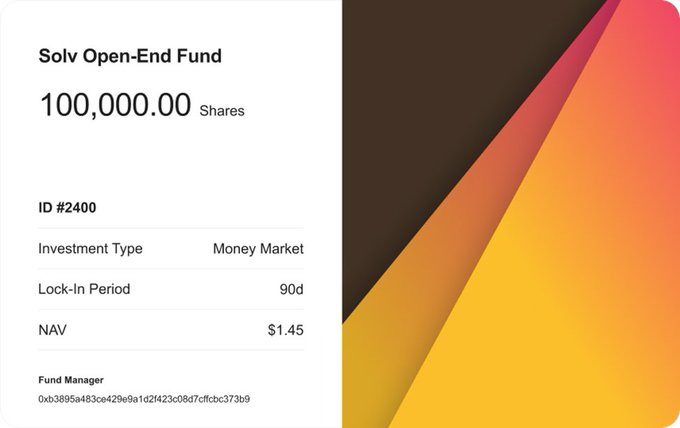

With V3, users can create various on-chain funds, such as fixed-income funds, money market funds, or even tokenized REITs, to increase liquidity and manage assets at a low cost.

Moreover, investors can engage in alpha and smart beta strategies to achieve superior returns. Solv V3 also provides a real-time, visualized dashboard to monitor PnL (Profit and Loss) and NAV (Net Asset Value), with easy options for withdrawal through trading or borrowing against SFTs (Semi-Fungible Tokens).

A key highlight of Solv V3 is its ability to manage and liquidate SFTs for on-chain funds. Asset managers can create SFTs with customizable subscription rules, fee structures, and investment strategies via smart contracts, giving them the freedom to tailor funds to their specific objectives.

Investors who purchase SFTs become LPs (Liquidity Providers) and can trade or exit the fund flexibly on secondary markets. With full smart contract automation, principal and interest distributions are transparent and efficient.

Additionally, Solv V3 integrates both centralized and decentralized custody solutions, offering managers flexibility to align with their goals. Solv also incorporates APIs from leading crypto analytics and exchanges to provide thorough tracking of NAV and fund transactions.

Particularly, Liquidity Pool 2.0, built on SFT technology, enables asset managers and LPs to benefit from personalized, flexible liquidity pools with optimized gas efficiency, delivering a cutting-edge LP experience.

3.2.2) Abitrum & RWA – Catalysts for New Growth

Since the launch of Version 3, Solv has quickly partnered with @izumi_Finance —one of the leading providers of Multichain Liquidity-as-a-Service (LaaS). This collaboration allowed iZUMi to issue a $1.35M USDC Stablecoin Fund on the Solv V3 platform, aimed at providing liquidity to major DEXs on Arbitrum and BNB Chain.

The initial success of this partnership showcased Solv’s ability to facilitate the issuance of a total of $115M in funds, generating over $600K in profits for investors.

iZUMi Finance: Issued $29M and distributed over $205K in profits. Their prominent funds include the iZUMi Fund Senior (APR 7%) and iZUMi Fund Junior (APR 31.6%).

Binquant: Issued $25M with a Neutral Strategy Fund yielding 4% APR.

Whale 0xbb: Managed over $17M, distributing $59K in profits from their Delta Neutral Fund (APR 4%).

Whale 0x65: Managed over $15M, generating $52K in profits from their Market Making Fund.

CCL: Managed $8M and distributed $27K in profits with a 4% APR.

Perpetual Protocol: Managed $3M, distributing $50K in profits from the Perpetual-Convertible Fund (APR 5%).

In June 2023, Solv launched the Blockin GMX Delta Neutral Pool. This pool provides liquidity on GMX and implements hedging strategies on Binance, transforming GLP into a safe, low-risk stablecoin mining pool with high returns.

This strategy proved highly effective, as GMX’s TVL reached nearly $600M at its peak, while the Arbitrum ecosystem remained the only one with positive momentum, reaching around $2B in TVL. Notably, this occurred at a time when the broader market was entering a decline, initiated by major market makers like Jump Trading and Jane Street withdrawing from the crypto market.

Not limiting itself to DeFi, Solv has expanded into the Real World Asset (RWA) sector. On September 22, 2023, Solv launched the RWA Fund, providing investors with access to U.S. Treasury bonds through stablecoins. This fund is designed for those seeking returns from real-world assets while maintaining the stability of their investments in stablecoins.

The Solv RWA Fund strategically invests in U.S. Treasury bonds, specifically ISIN US91282CDR97. As of August 3, 2023, this bond had an impressive yield to maturity (YTM), reaching up to 5.40%.

https://app.solv.finance/fund/open-fund/detail/10

Thanks to the vision and effectiveness of V3, Solv successfully raised $6M for itsOn-Chain Fund Mission from prominent partners such as Laser Digital, UOB Venture Management, Mirana Ventures, Emirates Consortium, Matrix Partners, Bing Ventures, Apollo Capital, HashCIB, Geek Cartel, and Bytetrade Labs.

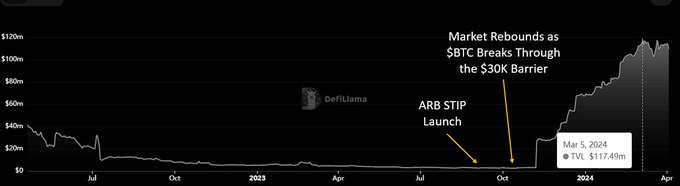

While the "black swan" event in 2022 triggered an explosive increase in trading volume and fees on Solv's V1 and V2, it also caused the TVL to sharply drop to under $5M. However, the strategic positioning of Solv’s funds on GMX began to bear fruit after the launch of the Arbitrum Short-Term Incentives Program (STIP) in Q3 2023. This, combined with the broader market recovery in October 2023, marked a major turning point for Solv’s growth.

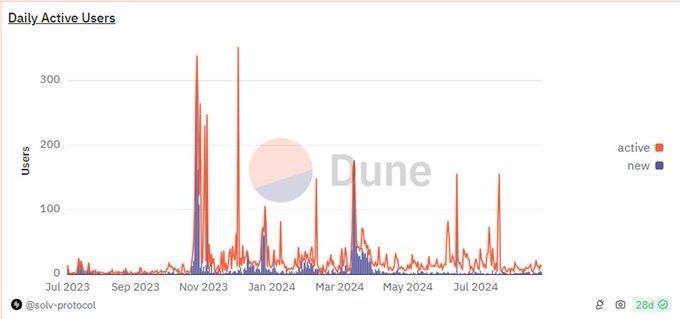

The Total Value Locked (TVL) on Solv skyrocketed from around $3 million to $30 million, a tenfold increase, and reached an all-time high of approximately $117.49 million by March 2024—an extraordinary growth of 3,816.33% from its lowest point. Daily active users on Solv also surged, surpassing 300 by November 2023.

https://dune.com/solv-protocol/solv-v3

The majority of Solv’s liquidity stems from Bitcoin and Ethereum, primarily flowing through GMX pools, with trading volumes peaking at $29 million in Q3. Additionally, Solv launched the MUX Protocol Delta Neutral Pool, specifically designed for the MUXLP pool. This strategy aims to optimize returns for liquidity providers (LPs) while minimizing market volatility.

https://dune.com/solv-protocol/solv-protocol-vaults

3.3) The Grand Surge: Solv Protocol's Monumental Growth

3.3.1) The Decline of Arbitrum's Market Share

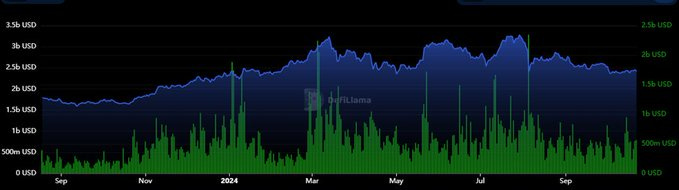

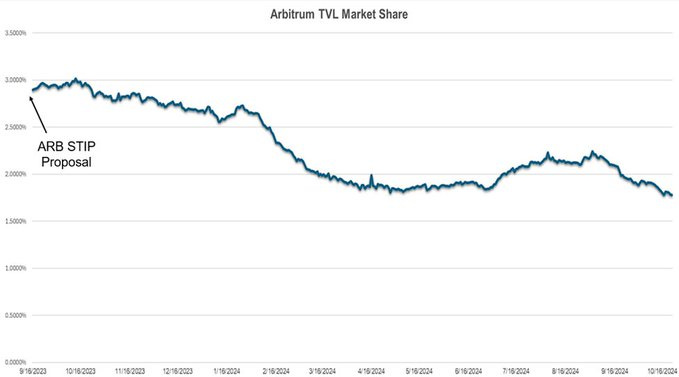

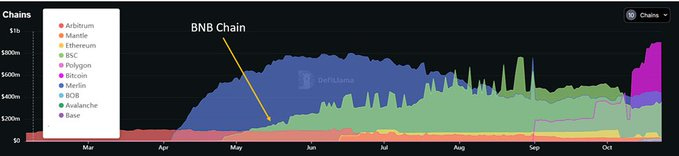

While the ARB STIP program proved effective for the Arbitrum ecosystem towards the end of 2023, it wasn't enough to maintain its competitive edge against the increasingly fierce competition from other ecosystems. It's important to note that this lack of dominance doesn't indicate any internal issues with Arbitrum, as its TVL remained robust and even experienced steady growth, surpassing the $3 billion mark by June 2024.

However, following the market-wide hype that spanned from Q3 2023 to Q1 2024, coupled with the explosive rise of Meme Season on Solana and Base, Arbitrum's TVL market share saw a significant decline compared to other ecosystems.

Since the initial launch of ARB STIP, Arbitrum's market share dropped sharply from approximately 2.89% to 1.7787% as of October 22, 2024. This decline not only impacted the overall status of the Arbitrum ecosystem but also affected Solv V3 products, which had been instrumental in reviving Solv's TVL after the 2022-2023 downtrend.

3.3.2) A New Direction

3.3.2.1) Native Yield Assets Driven by Strategic Trading

Therefore on February 28, 2024, Solv officially launched a new strategic direction with the introduction of "Native Yield Assets Backed by Trading Strategies" marking a significant turning point in the strong growth of its Total Value Locked (TVL) in the months that followed.

In the initial phase, Solv will focus on key products like SolvBTC offering native yield opportunities for major assets such as $BTC.

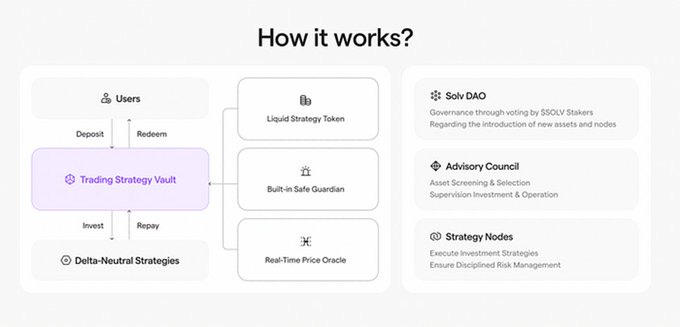

Essentially, this strategy is an enhanced version of the V3 product, where Native Yield Assets allow users to deposit their assets into Trading Strategy Vaults and receive Liquid Staking Tokens (LSTs) in return.

The Vaults will then allocate liquidity from the Native Yield Pools (SolvBTC) into separate strategy-specific Vaults on Solv. Each Vault follows its own independent trading strategy, carefully selected to ensure delta neutrality and safeguard user interests.

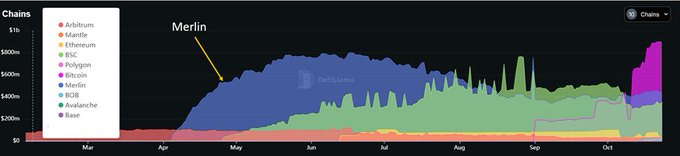

As previously mentioned, Solv's strategy of "Native Yield Assets Backed by Trading Strategies" has served as a powerful catalyst, driving substantial TVL growth since Q2 2024. Let’s explore the key events that contributed to this surge, particularly on the Merlin ecosystem.

On March 19, 2024, Solv launched SolvBTC—a Native Yield Asset enabling users to deposit their$BTC across networks like Ethereum, Arbitrum, BNB Chain, and Merlin Chain. Notably, Merlin joined the race by introducing Merlin’s Seal in February, paving the way for Farming Points and drawing liquidity into Merlin’s DeFi ecosystem to generate both Yield and Points.

A crucial milestone was the launch of Solv’s Point system on April 5, 2024, which allowed users to earn Farming Points through various ecosystem activities. Users leveraging SolvBTC to dive deeper into DeFi earned significantly boosted Points compared to simply holding the asset.

Building on this momentum, Solv partnered with Merlin to launch the Solv x Merlin Incentive Program, offering attractive rewards in both Solv Points and Merlin Points across two phases. These strategic moves drove substantial inflows into Solv, as users transferred SolvBTC into Merlin, staking and minting directly on Merlin Chain, while simultaneously participating in Farming Points from both projects. This synergy sparked significant interaction and accelerated growth for both ecosystems.

The impact of these actions is evident in Solv's TVL within the Merlin ecosystem, which saw a sharp rise—from around $23.8M just one day before the launch of Solv Point, to an all-time high (ATH) of $802.14M on June 17, 2024, marking a staggering 3270% increase.

Not only did Merlin garner attention, but BNB Chain also saw a significant surge, with Solv's TVL on BNB skyrocketing from $250.81K to an impressive $766.76M—a staggering 305,613% increase—following the launch of SolvBTC’s Liquidity Pools on the BNB Chain.

As a result of Solv's launch of Native Yield Assets backed by trading strategies, along with the introduction of the Point System and strategic partnerships with other chains, Solv Protocol’s TVL surged from $108.84M to an all-time high of $1.403B on June 17, 2024—marking an astonishing growth of 1,288,948%.

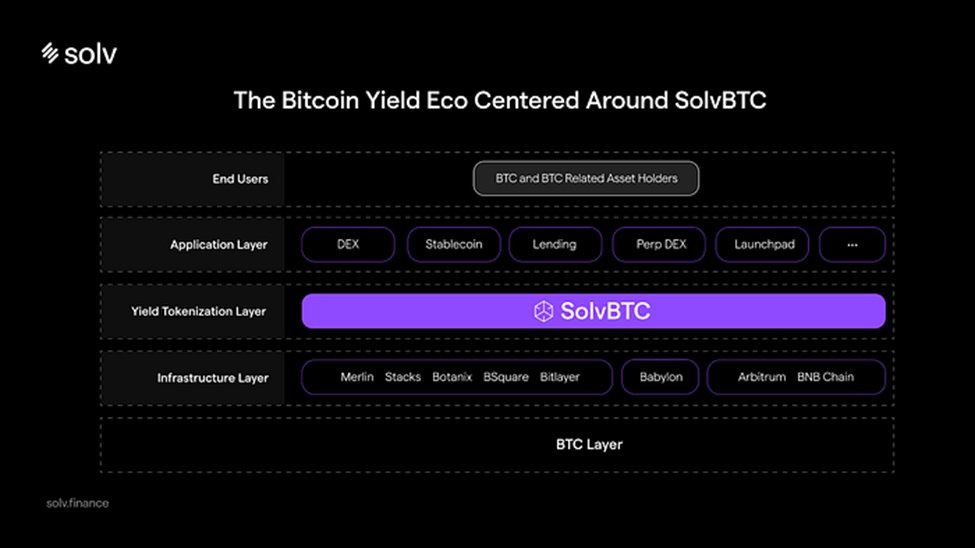

3.3.2.2) SolvBTC: Expanding the Frontiers of BTCFi with Solv Protocol

As mentioned, SolvBTC plays a pivotal role in Solv Protocol's yield-generating strategies. In response, Solv has swiftly introduced Vaults to maximize the benefits of Native Yield Assets, particularly SolvBTC.

Users can not only securely hold their assets but also unlock potential returns through DeFi and earn airdrops from strategic partners, providing an optimal and efficient way to grow their asset value. Currently, Solv Protocol has developed Vaults such as Babylon, Ethena, Core, and Jupiter.

A) Babylon & SolvBTC.BBN

The rise of Eigenlayer, with its ability to leverage vast amounts of capital from$ETH, became a major focal point in attracting market attention and capital flows during the first half of 2024. However, when compared to the potential capital that Bitcoin can bring, $ETH remains relatively smaller. This is precisely why Babylon was born. With a model similar to Eigenlayer, Babylon quickly secured $96M in investments from major funds like Paradigm, Polychain Capital, HashKey Capital, Binance Labs, Hack VC, and Galaxy.

The key advantage of Solv Protocol lies in its native asset, SolvBTC – a unique asset that allows users to fully capitalize on Babylon’s growth as its mainnet launches. Recognizing this vast potential, Solv swiftly integrated with Babylon, providing users with attractive Restaking Yield opportunities.

To seize the momentum from Babylon’s pre-mainnet surge, Solv promptly rolled out Babylon Vaults, allowing users to stake SolvBTC and receive SolvBTC.BBN in return.

SolvBTC.BBN is an LST (Liquid Staking Token) representing Bitcoin staked within the Babylon ecosystem, utilizing Bitcoin’s economic strength to secure Proof-of-Stake (PoS) networks.

Vault Operation: Earn rewards by staking $BTC to secure Babylon.

Type: Pegged 1:1 to BTC.

Yield: Users earn native token rewards from PoS chains secured by Babylon via SolvBTC.BBN while maintaining Bitcoin liquidity.

Utility: SolvBTC.BBN can be used across the Babylon ecosystem in DeFi, liquidity pools, and cross-chain protocols.

B) Ethena & SolvBTC.ENA

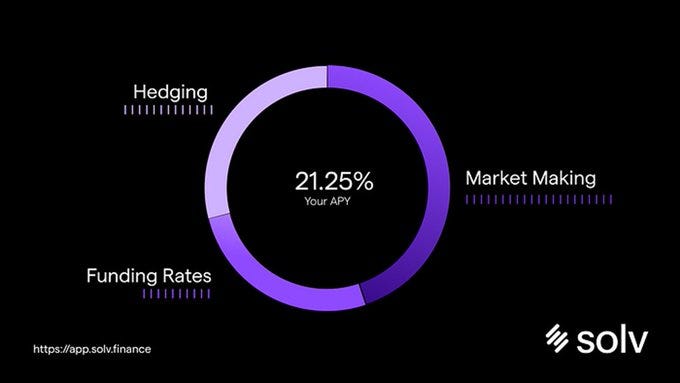

Unlike the Babylon Vaults, the Ethena Vault offers users the opportunity to stake SolvBTC and receive SolvBTC.ENA in return. SolvBTC.ENA is a liquid staking token (LST) for Bitcoin, utilizing a unique basis trading strategy within the Ethena ecosystem. This innovative approach allows Bitcoin holders to maximize their earnings from Ethena's ecosystem while maintaining full control over their Bitcoin assets, creating an ideal balance between security and profitability.

How the Vault works: Earn rewards by staking BTC as collateral to mint and stake Ethena's USDe, enhancing the security of the Ethena network.

Type: Profit-yielding liquid staking token.

Yield: Users benefit from Ethena's staking returns and can leverage up to 10x SATs from borrowed stablecoins, all while maintaining liquidity of their Bitcoin.

This strategy involves using Bitcoin as collateral to borrow stablecoins, which are then minted and staked in Ethena's USDe. The profits come from two primary sources:

Ethereum Staking & Funding: Users earn returns through staking on the Ethereum network.

Basis Spread: Additional gains are made through hedging against derivative positions.

C) Core & SolvBTC.CORE

The Core Vault enables users to stake SolvBTC and receive SolvBTC.CORE in return. SolvBTC.CORE is a liquid staking token (LST) that represents Bitcoin staked within the CoreDAO ecosystem. This allows Bitcoin investors to both secure the Core network and retain liquidity for their Bitcoin on the Core platform.

• Vault Functionality: Stake $BTC to help secure the CoreDAO network and earn real returns in $CORE.

• Type: Pegged 1:1 with $BTC.

• Yield: Users receive rewards from the CoreDAO ecosystem through SolvBTC.CORE, while maintaining liquid access to their Bitcoin.

• Utility: SolvBTC.CORE can be leveraged in various DeFi applications, liquidity pools, and cross-chain protocols, enhancing its flexibility and use across the ecosystem.

D) Jupiter & SolvBTC.JUP

Solv Protocol is not only focused on opportunities within the EVM Chain but has also expanded into the Solana ecosystem with the launch of SolvBTC.JUP on Jupiter.

Jupiter, which features a tokenomics model similar to GMX, is currently offering an impressive APY of around 28%. This enables Solv to implement hedging strategies with an estimated yield of up to 12% on Bitcoin. However, the Vault is still in its testing phase and not yet available for public staking.

3.3.2.3) Staking Abstraction Layer (SAL)

The Staking Abstraction Layer (SAL) is the core infrastructure of Solv Protocol, designed to simplify the process of staking Bitcoin across multiple ecosystems and provide users with a unified interface. With SAL, Bitcoin holders can diversify their yield-generating strategies across various blockchains while retaining liquidity through SolvBTC.

SAL integrates with multiple DeFi platforms, removing barriers and enhancing transparency, allowing users to tap into key yield sources, including:

• Restaking: Earn token rewards from platforms like Babylon, EigenLayer, and Symbiotic.

• Validator Rewards: Secure Layer 2 networks such as CoreDAO, Stacks, and Botanix and receive staking rewards.

• Trading Strategies: Engage in delta-neutral strategies on platforms like GMX, Ethena, and Jupiter to generate stable yields from BTC.

This makes SAL a powerful tool for unlocking diverse, stable returns without sacrificing liquidity.

3.3.3) On-Chain Metrics

We have just reviewed the comprehensive recovery and growth strategies that Solv Protocol has implemented to adapt impressively to the market's volatility over the past few years.

Notably, Solv's Total Value Locked (TVL) is now approaching the $2 billion mark—a remarkable achievement compared to its early days when the protocol was still striving to gain traction with Version 1.

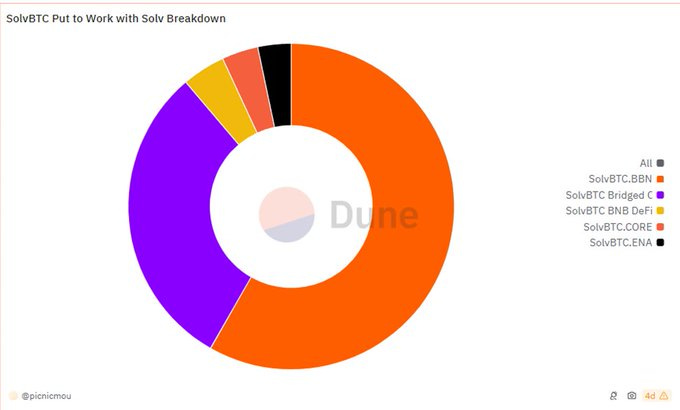

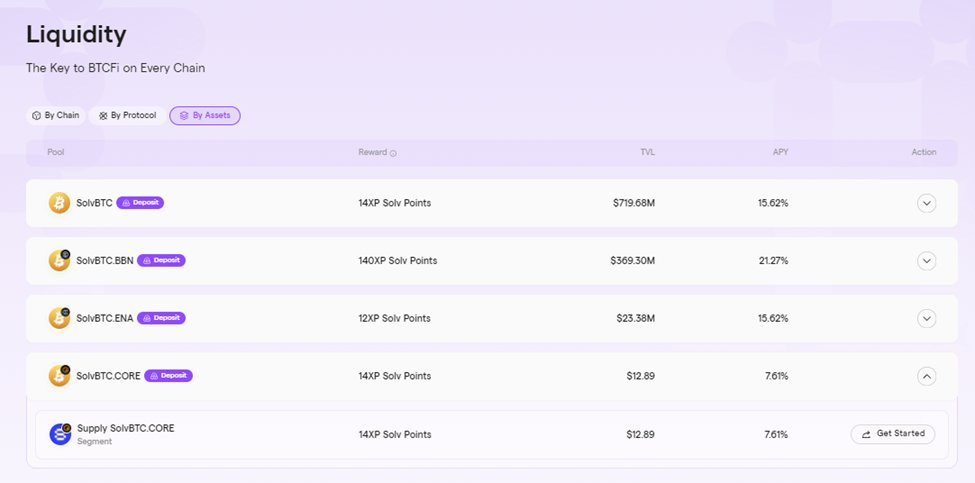

Although Solv Protocol offers multiple Vaults for users to stake SolvBTC, the majority of activity remains concentrated in SolvBTC.BBN. This highlights the strong appeal of Babylon and the higher airdrop expectations associated with it compared to other strategic Vaults.

https://dune.com/picnicmou/solv-protocol

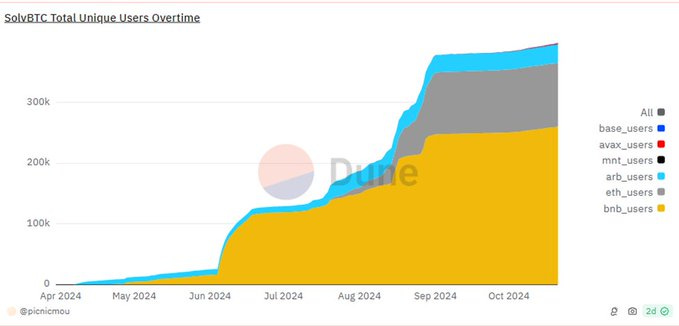

Moreover, BNB Chain has emerged as the most active chain on Solv Protocol, accounting for 63% of the total user base across other chains.

https://dune.com/picnicmou/solv-protocol

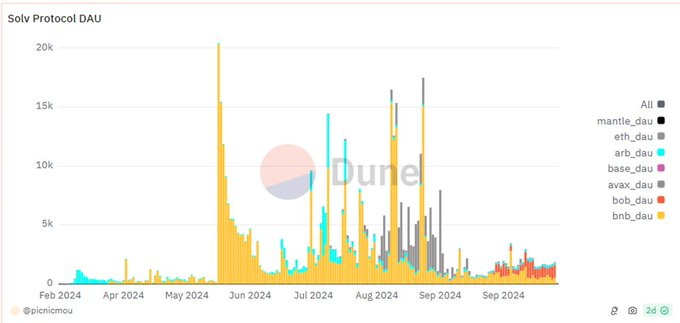

We are witnessing the powerful impact of the Farming Airdrop wave, not only through the concentration of users holding SolvBTC.BBN but also reflected in the significant growth of DAU (Daily Active Users) on Solv. While BNB Chain remains the primary driver of DAU, the latter part of Q2 and Q3 saw a notable shift in user activity towards chains like Mantle and BOB, which, despite not having tokens yet, are running enticing Pre-TGE Incentive campaigns that are effectively attracting users and influencing behavior.

https://dune.com/picnicmou/solv-protocol

4) Optimizing Farming Point Strategies on Solv Protocol

In this section, I’ll focus on optimizing Airdrop farming through the Point System on Solv Protocol. As mentioned my previous post, there are two main approaches for participating in Farming Points.

The basic approach involves holding Liquid Restaking Tokens (LRT) or Liquid Staking Tokens (LST) in your wallet, providing a straightforward yet rewarding path. Meanwhile, the advanced approach carries more risk but significantly increases your chances of earning more Airdrops on Solv, as well as additional tokens from other projects.

Before diving into the strategies for both approaches, ensure that your account is activated to start earning Solv Points here.

4.1) Basic Approach

4.1.1) Guide to Acquiring SolvBTC

Currently, Solv Protocol supports staking Bitcoin across 9 different chains to receive SolvBTC, including:

Ethereum: supports FBTC, WBTC, cbBTC.

BNB: supports BTCB.

Arbitrum: supports WBTC.

Avalanche: supports BTC.b.

Merlin: supports M-BTC.

Mantle: supports FBTC.

BOB: supports WBTC.

Base: supports cbBTC.

Bitcoin: supports Bitcoin.

Points, rather than just Solv Points, compared to staking with other Bitcoin derivatives.For optimal staking to receive SolvBTC, it is recommended to prioritize Mantle and Ethereum. When staking on these chains, use Ignition's FBTC. This way, you’ll earn both Solv Points and Ignition

4.1.2) Guide to Acquiring LRT Tokens from SolvBTC

Once you have acquired SolvBTC, there are four different paths for restaking, depending on your preferences and the project you wish to support:

• If you're interested in Babylon, you can restake SolvBTC in the Babylon Vault to receive SolvBTC.BBN. Supported networks include Ethereum, BNB, Arbitrum, Avalanche, Merlin, Mantle, BOB, Base, and Bitcoin. Rewards: Ignition Spark (FBTC), Solv Point, and Babylon Point.

• If you're more inclined towards Ethena, restake SolvBTC in the Ethena Vault to get SolvBTC.ENA. Supported networks include Ethereum, BNB, Arbitrum, and Merlin. Rewards: Ignition Spark (FBTC), Solv Point, and Ethena SATs.

• For those interested in Core, you can restake SolvBTC in the Core Vault to obtain SolvBTC.CORE. Supported networks: Core. Rewards: Ignition Spark (FBTC), Solv Point, and Core Ignition Drop.

• If you're interested in Jupiter, restake SolvBTC in the Jupiter Vault to receive SolvBTC.JUP, supported by the BNB Chain. Please note that this vault is currently inactive.

In this guide, I'll use SolvBTC.BBN and the BNB Chain as examples for more in-depth strategies. However, similar strategies apply across other projects such as SolvBTC.ENA, SolvBTC.CORE, and SolvBTC.JUP—feel free to explore partnerships supporting these tokens.

4.2) Advanced Approach

4.2.1) Becoming a Liquidity Provider (LP) on Decentralized Exchanges (DEXs)

On the BNB Chain, you have three main strategies to consider:

Become an LP on Tranchess in the staYSBBBN-SolvBTC.BBN pair to earn 14XP points plus $CHESS rewards. Additionally, if you lock your SolvBTC.BBN to hold turPSBBBN on Tranchess, you’ll receive 140 XP points for every dollar’s worth of SolvBTC.BBN that you lock.

Become an LP on DODO in the SolvBTC-SolvBTC.BBN pair, where you’ll earn 14XP points along with $DODO rewards and enjoy a 5.71% APR.

Become an LP on PancakeSwap in the SolvBTC.BBN-SolvBTC LP pair to gain 14XP points, $CAKE rewards, and an APR of 2.43%.

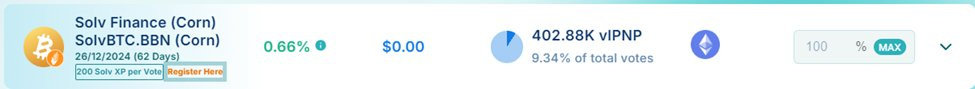

4.2.2) @pendle_fi and Strategic Opportunities

There are essentially three ways to leverage opportunities on Pendle:

Pendle LPs By becoming an LP (Liquidity Provider) on Pendle, you not only earn points on Solv but also enjoy an impressive 11.54% APY along with $PENDLE incentives. To maximize your APY and receive even more rewards, make sure to hold vePendle, which boosts your APY as an LP.

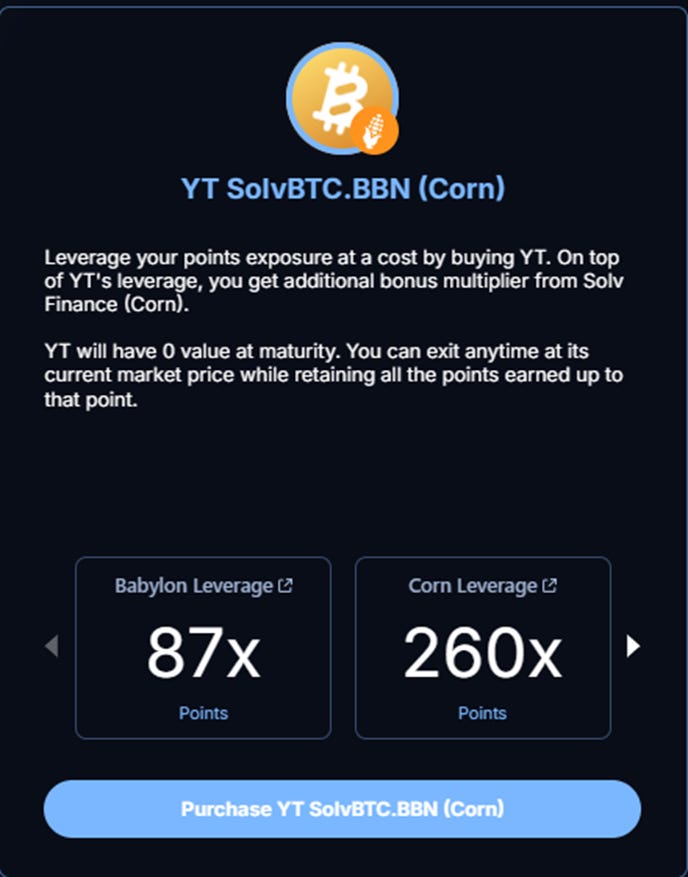

Trading YT In addition to becoming an LP, you can engage in YT trading and hold YT tokens to leverage points. However, be cautious, as YT tokens will expire and become worthless upon maturity. When trading YT, you'll earn: 87X Babylon Leverage Points+ 260X Corn Leverage Points+ 1212.59 Solv XP per $WBTC.

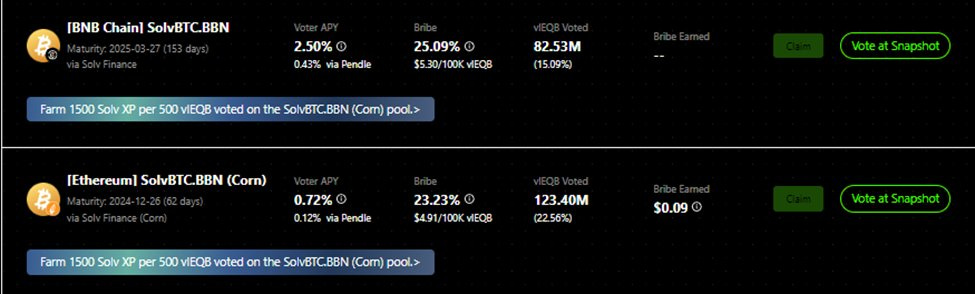

Pendle Wars:

Voting Power: If you don’t have Bitcoin to stake and receive SolvBTC.BBN, you can still participate by purchasing $PNP or $EQB, locking them, and voting for SolvBTC.BBN pools to earn points with each vote.

LPs: Beyond being an LP on Pendle, you can also become an LP on @Penpiexyz_io and @Equilibriafi . These platforms offer similar incentives as Pendle, but with the added benefit of earning $EQB and $PNP token incentives along with 14XP Solv Points.

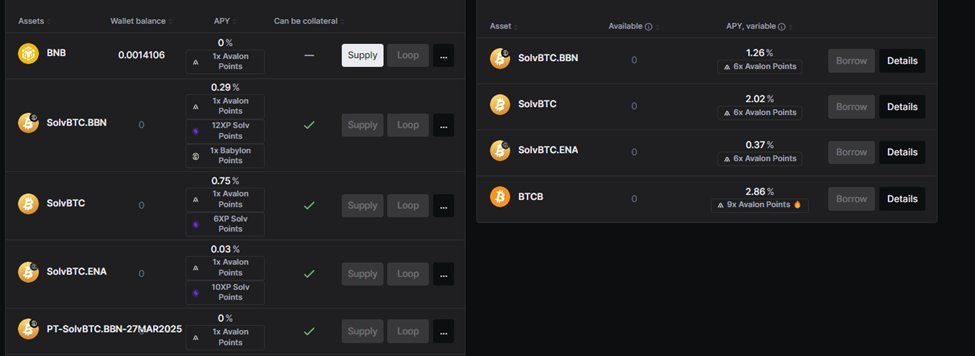

4.2.3) Lending and Looping Strategies

Currently, Avalon has integrated support for a wide range of Bitcoin LST/LRT assets, including full coverage for Solv's Native Yield Assets such as PT-SolvBTC.BBN. There are two key strategies available for us on Avalon:

Looping: Collateralize SolvBTC.BBN (earn 14XP Solv Point + Babylon Point + Avalon Point for each dollar of SolvBTC.BBN collateralized) and borrow either SolvBTC.BBN or SolvBTC. Then, restake the borrowed assets in the Babylon vault to mint more SolvBTC.BBN, and repeat the process (loop). The effectiveness depends on the borrowing rate at the time you start.

PT Looping: When you hold a Principal Token (PT), you’re essentially holding the underlying assets and thus don't earn Points. However, with Avalon, you can collateralize PT-SolvBTC.BBN maturing on 27/03/2025 (earn Avalon Point), borrow SolvBTC.BBN or SolvBTC, and restake it in the Babylon vault to mint more SolvBTC.BBN. By continuing the loop, you can earn Solv Point, Babylon Point, Avalon Point, and enjoy fixed yields from holding PT.

4.2.4) Mega Farming

Beyond DeFi ecosystems that already have tokens, you can bridge SolvBTC.BBN to emerging ecosystems like Corn, Fuel, or restaking platforms such as Pell and Satlayer to maximize your points.

This not only enhances your boosted points on Solv Protocol but also allows you to farm additional points in ecosystems running Point Incentive programs, along with their respective DeFi protocols. Currently, the following opportunities are available:

@use_corn Layer 2 on Ethereum: Utilizing Bitcoin as gas, it is currently in the deposit phase to earn points before the ecosystem fully launches. Users can bridge to Corn early to accumulate extra Corn points.

@fuel_network: Now in Phase 2, enabling users to leverage their assets to participate in the Fuel DeFi ecosystem.

Additional Restaking Platforms: Users can deposit SolvBTC.BBN to earn extra points from projects such as @satlayer, @MezoNetwork, and @Pell_Network.

5) Summary

Since 2021, Solv Protocol has not only demonstrated remarkable flexibility in product innovation but also showcased an exceptional ability to seize opportunities and anticipate emerging market trends.

Solv's success is evident in its ability to adapt to different phases of the market: from the launch of V3, capitalizing on the Arbitrum wave by focusing on GMX and Real World Assets (RWA), to later leveraging the Restaking trend with Native Yield Assets.

Notably, Solv's strategic collaborations with ecosystems offering Point Incentives, alongside campaigns encouraging users to transition to these ecosystems, created a powerful synergy, providing a significant competitive advantage.

Thanks to these strategic moves, Solv Protocol has not only weathered the Downtrend but has experienced a remarkable revival and growth since late 2023.

I hope this information provides you with a clear overview of Solv Protocol's Go-to-Market strategies and how the platform has successfully adapted to the evolving market landscape.

This article is not investment advice; all information mentioned in this article should be considered as reference material. DYOR and be responsible for your money.